VAT and taxes

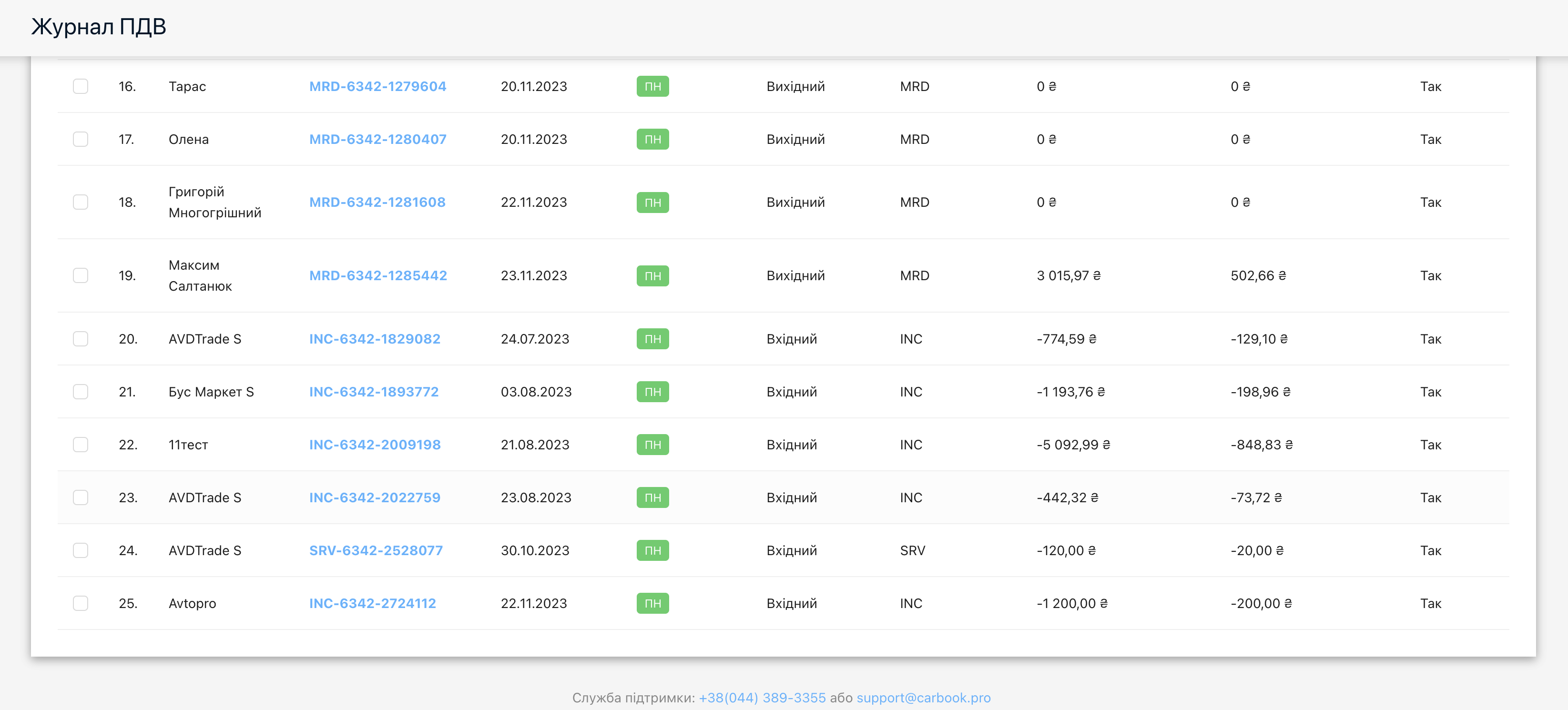

TryVAT at service stations (STO) plays a key role in the financial process. Registration of input VAT includes receipt of tax invoices for purchased materials or services, which are a component of servicing cars at service stations. Output VAT is formed in accordance with operations for the provision of car maintenance services, including repair, maintenance and spare parts. The reflection of these transactions in the relevant tax documents is an important component of fiscal activity at the STO.